The crushing costs of home ownership and raising a family could be driving the latest upswing in household debt.

High debt levels reflect the damn-the-consequences style of consumption encouraged by low interest rates and the prompts to spend we get from immersion in the internet and social media. But an analysis of household finances in eight cities across the country shows another side to the debt story. Between high housing and daycare costs, even families with an upper-middle-class income may not be able to live within their means in some cities. Debt for them is about getting by, not living it up.

The credit reporting firm Equifax said this week that 46 per cent of indebted people paid down the amount they owed in the final three months of 2017, while 37 per cent increased their borrowing. The two trends net out as a 3.3 per cent year-over-year increase in non-mortgage debt per person to $22,837.

Statistics Canada reported on Thursday that the ratio of debt to disposable income, a well followed measure of indebtedness, declined in the fourth quarter of 2017 to 170.4 per cent from 170.5 per cent in the previous three months. But if you look at borrowing behaviour on its own, an alarming trend emerges.

The Equifax numbers came out as yet another global organization, the Bank for International Settlements (BIS), warned about household debt levels in Canada. The BIS said measures that compare borrowing to economic output and debt payments as a share of income suggest there are risks to the banking system in this country.

Warnings about high debt levels have come from both inside and outside the country in recent years and their effect can be seen in the fact that almost half of borrowers reduced their balance owing in the last quarter of 2017. You could easily miss this good news if you looked at the overall numbers, though.

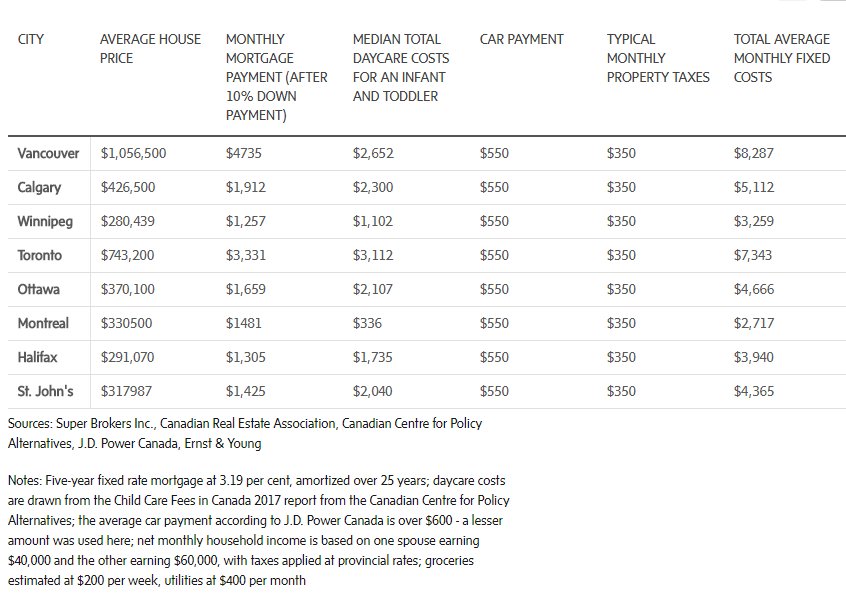

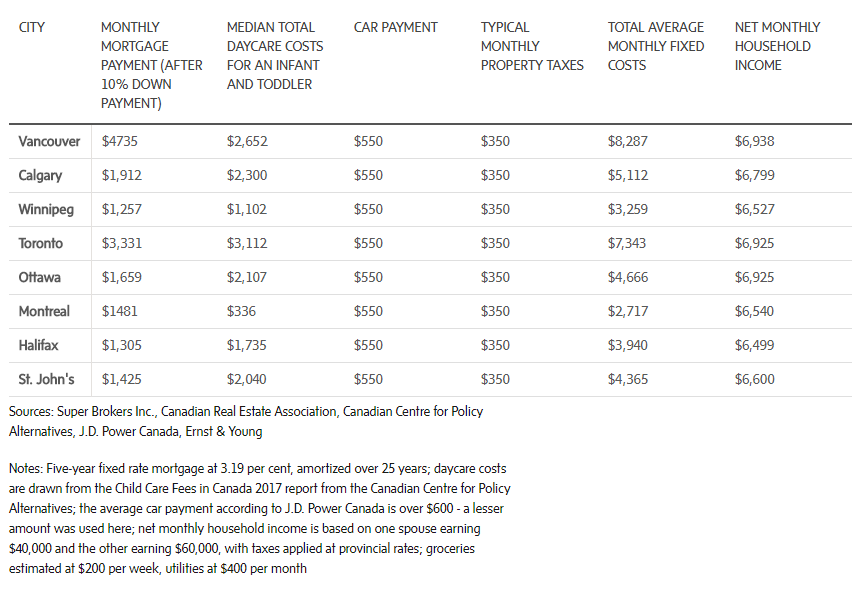

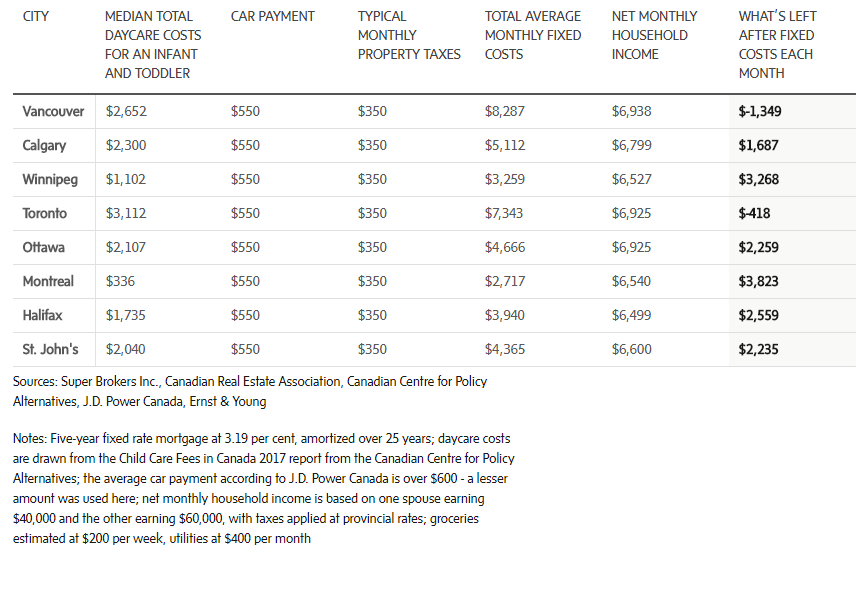

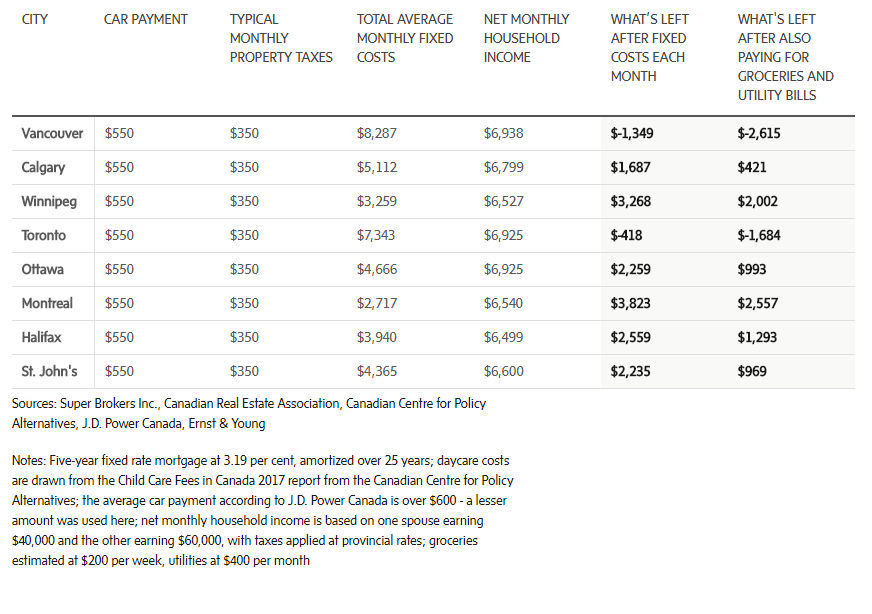

Equifax’s theory is that increased borrowing by the segment of the population raising families – ages 36 to 55 – is behind the overall rise in debt. The analysis of family finances backs up this view. Of the eight cities examined, two are an affordability catastrophe, three are dicey and three are ideal for families. Winnipeg, Montreal and Halifax, take a bow.

The unaffordable cities are Toronto and Vancouver. Imagine a two-income household grossing a combined $100,000 a year living in an average-priced home bought with a 10-per-cent down payment. Add an infant and toddler, both in daycare, a monthly car payment, property taxes, utilities and grocery costs and you end up with expenses that could exceed net income by $1,500 or more.

A similar family living in Vancouver would be underwater by even more. Note that while a variety of home-ownership costs have been considered here, upkeep and maintenance have been left off because there is at least a little bit of discretion on when and how much to spend. These costs are often estimated at 1 per cent of the value of the home a year on average.

Data from the 2016 census updated using recent inflation numbers put the median total household income level at about $74,500. So a $100,000 household in Toronto and Vancouver is comparatively well off and easy to assign to the upper end of the middle class. Shouldn’t you be able to live within your means at this income?

You can more or less do this in Ottawa and St. John’s and, to a lesser extent in Calgary. In Winnipeg, Montreal and Halifax, there is definitely enough left over for family needs beyond the bare necessities. All three of these affordable cities offer reasonably priced houses and/or manageable day care costs.

Rising debt among families raises questions about how our financial system judges whether someone can afford to buy a house. Affordability measures focus only on the financial position of a person at the time of purchase – they don’t anticipate the financial impact of having kids and adding car payments and other debts.

As a result, it’s easy to buy a house you can afford in the present but not in the future. Debt via credit cards or lines of credit is how you get by when your house and daycare costs overwhelm your income. Try our Real Life Ratio calculator to see how affordable home ownership is with the full range of costs and obligations factored in.

The years of raising a family with young kids are always going to be the most financially stressful. Modest, occasional use of debt to cover expenses temporarily is okay, but the latest debt numbers suggest something more alarming is happening. Crushed between high mortgage and daycare payments, some families may be using debt to survive.

DRIVEN TO DEBT

Some Canadian cities are affordable for a couple grossing $100,000 a year. But between mortgage payments, daycare and other costs, living in other cities at this income level is a stretch. This may help explain why debt levels continued to rise overall in the final three months of 2017, even as many people reduced the amount they owe.

ROB CARRICK

Personal Finance Columnist

The Globe and Mail, March 15, 2018